Member savings njbia

Table of Contents

Table of Contents

Are you an owner of a small business and want to know how are owner draws taxed? Well, you’ve come to the right place. In this article, we will discuss everything you need to know about owner draws and their tax implications.

Pain Points For Small Business Owners

As an owner of a small business, it can be challenging to navigate the tax laws surrounding owner draws. Not understanding these laws can result in penalties and fines, which could adversely affect your business’s growth. Furthermore, if you don’t keep proper records, it can be even more challenging to file taxes correctly.

Answer to How are Owner Draws Taxed

Owner draws are the distributions you take from your business’s profits, and they aren’t taxed like a salary or wages. Instead, they’re considered a return on investment, which is subject to taxation at the individual levels. When you take owner draws, they aren’t treated as payroll expenses, which makes calculating payroll taxes a little more complex.

Summary of Main Points

To summarize, owner draws are not taxed as a salary or wage, and they are a return on investment. Calculating payroll taxes can be complicated because owner draws are not treated as payroll expenses. Keep accurate records of all your owner draws, and file taxes correctly to avoid penalties and fines.

How Owner Draws Are Taxed

As a small business owner, I have experience with owner draws and how they’re taxed. After doing some research, I found it beneficial to open a separate business bank account for my owner draws. This way, I can keep track of my business’s finances separately from my owner draws.

Furthermore, it’s essential to keep a record of all owner draws you take from your business. You can easily do this by keeping receipts and proof of any transactions made from your business account. It’s also vital to keep track of the timing of your owner draws because this can affect your taxes.

Furthermore, it’s essential to keep a record of all owner draws you take from your business. You can easily do this by keeping receipts and proof of any transactions made from your business account. It’s also vital to keep track of the timing of your owner draws because this can affect your taxes.

Understand the Tax Implications of Owner Draws

If you’re taking owner draws from your small business, you need to understand that these distributions carry tax implications. Owner draws are classified as pass-through income, which means that they’re taxed at the individual level. Furthermore, the tax rate for owner draws may be different from the tax rate for salaries and wages.

### Keeping Accurate Records of Owner Draws

### Keeping Accurate Records of Owner Draws

Keeping accurate records of all your owner draws is crucial for your tax return. Deductions claimed on tax returns will require supporting documents, and keeping a record of income and deductions will help you avoid penalties and unnecessary taxes. As a small business owner, staying compliant with tax laws is crucial for your business’s growth and success.

Conclusion of How Are Owner Draws Taxed

Understanding how owner draws are taxed is crucial when you’re a small business owner. To summarize, owner draws are distributions from your business’s profits and are not taxed as a salary or wage. Keeping accurate records of your owner draws and understanding the tax implications of pass-through income is crucial for staying compliant with tax laws and avoiding any penalties or fines.

Question and Answer

Q. What is the difference between an owner draw and a salary?

A. The main difference is that a salary is taxed as ordinary income, while an owner draw is not. An owner draw is treated as a return on investment and can affect the tax rate for the individual taking the draw.

Q. Can I take owner draws from my business if it is operating at a loss?

A. Yes, you can. However, there may be tax implications if the business is operating at a loss for an extended period. It’s advisable to consult a tax professional for guidance.

Q. Can I take multiple owner draws in a single year?

A. Yes, you can take multiple owner draws as long as there are profits to distribute. However, it’s crucial to keep track of the timing of these draws, as it can affect your taxes.

Q. How do I report owner draws on my tax return?

A. Owner draws are reported as a separate item on your individual tax return, and you must keep accurate records to support your tax return. You should consult a tax professional if you need guidance on how to report owner draws on your tax return.

Gallery

How To Record Owner Draws Into QuickBooks | Bizfluent

Photo Credit by: bing.com / quickbooks owner draws record grandparents money saving tips into kilowatts draw paula mccullough updated september ehow

How To Record An Owner’s Draw - The YarnyBookkeeper

Photo Credit by: bing.com /

Quickbooks Owner Draws & Contributions | Chart Of Accounts, Quickbooks

Photo Credit by: bing.com / quickbooks accounting accounts owner chart contributions set equity sole record draws capital choose board business

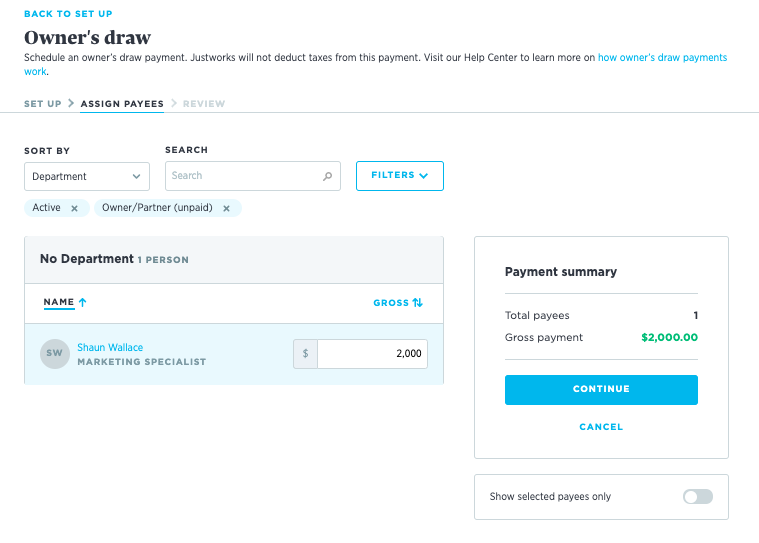

Scheduling Owner’s Draws – Justworks Help Center

Photo Credit by: bing.com / draws scheduling justworks deductions

Member Savings - NJBIA - New Jersey Business & Industry Association

Photo Credit by: bing.com / member savings njbia